We are a Nevada limited liability company established on October 23,2014. Our principal placed business is 1800 East Sahara Avenue, Suite 106, Las Vegas, Nevada 89104. We conduct business under our corporate name Toro Tax.Franchising, LLC and under the Tord TaXes trade name. Ourbusinessis operating the Toro Taxes franchise System and grariting franchises; to thifd;parties like you. to establish and .operate a Toro Taxes Business, Other than as discussed above, we. are not; in any other business, we have hot conducted business any other line of business and we; have not offered or sold franchises in any other line of business.

TOro Tax Services. Inc. buf predecessor Toro Tax Services, InC. was a California corporation that was incorporated on September 10, 2012 and maintained a principal place of business at 1924 S. Maryland Pkwy, Las Vegas, Nevada 89104. Toro Tax Services, Ind- previously offered and entered into license agreements granting third party licensees the right to utilize the System and Licensed Marks in connection with the operation of Toro Taxes Businesses. TOro Tax ServiCes, Inc., no longer offers licenses and will not offer licenses in the future. We disclose and identify Toro Taxes licensees with our franchisees ^in this; Disclosure; Document

You may enter into a franchise agreemerit in the fonn^attached to this.Disclosure Document (the “Franchise Agreement”) to establish and operate one Toro Taxes Business from a single Franchise Location. Your Franchise Agreement will designate whether or not your Toro Taxes Business is a Toro Taxes Store or a Toro Taxes Kiosk. You will be required to develop and operate your Toro Taxes Business in accordance with the requirements of our System and at a Franchise Location that we approve in wrifing., A Toro Taxes Franchise Location Will ordmafily be: located in retail shopping centers and similar high traffic retail consumer based commercial locations.. If you do not have an: approved site for your Franchised Location you must select a site in accordance with the Franchise Agreement, our standards and specifications, and, you must obtain our written approval of the Franchise Location. Your rights will be limited to tbe' establishment and operation: of a single location Toro Taxes Business that exclusively offers and provides Our System Products and Services and uses our System Equipment, Supplies arid Services from your Franchise^ Location.

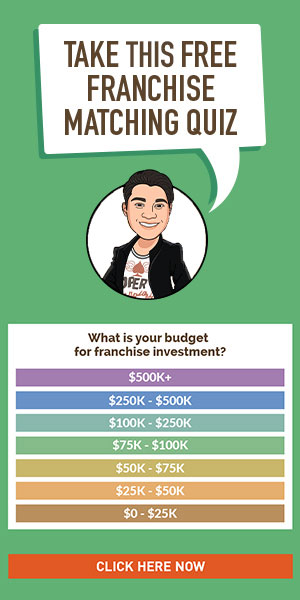

When you sign:a Franchise. Agreement, you will pay to us a non-refundable initial.franchise fee (the “Initial Franchise Fee”) of Twenty-Five Thousand Doliars ($25,000) for a Toro Taxes Store or a Toro Taxes Kiosk. The Initiai Franchise Fee is fully earned by us upon payment and non-:refundable, The method we use to calculate the Initial Franchise Fee is uniform for all franchises that wc offer through this PisclOsUre Document, except'that we offer; (i) the financing options for the Initial Franchise Fee described in Item l O; (ii) and the following discounts, which cannot be combined with one another and'which must be requested by you in writing, at the timC of signing the Franchise Agreement:

We may offer direct financing, but neither we nor our affiliates are obligated to provide any funding,to you. If you request indirect financing, we may recei ve a referral fee: from the third:;party finarieing provider. We do not guarantee your note, lease or obligation.

The FTC's FranchisevRuie perfnitS;.a Franchjspr'to provide information about the actual.pr potential financial perfoimance of its ifanchi'sed and/or frandhisor-owned outlets, if there is a reasonable basis for the information, and if the information is included in the disclosure document. Financial performance information that, differs from that included in Item 19 tnay be given only if:: ()) a franchisor provides the actual records of an existing outlet you are considering buyitig; or (2). franchisor supplements the information provided in this Item 19, for example; by providing informationsabout possible performance at a particular location or under particular circumstances.